When hiring, don’t overlook older workers

- ByPolk & Associates

- Jun, 29, 2022

- All News & Information

- Comments Off on When hiring, don’t overlook older workers

As the job market continues to feel the impact of “the Great Resignation,” competition for talent remains fierce. One area of the hiring pool that many businesses overlook is older workers. They can bring years of experience and industry connections while being self-motivated and easy to supervise. To facilitate the transition, inform your staff of older workers’ arrival (as appropriate) and involve current employees in the hiring process. In addition, provide training to managers, who might suddenly find themselves supervising workers with many more years of employment history. Consider establishing a mentorship program, too. Contact us for help assessing and managing your hiring costs.

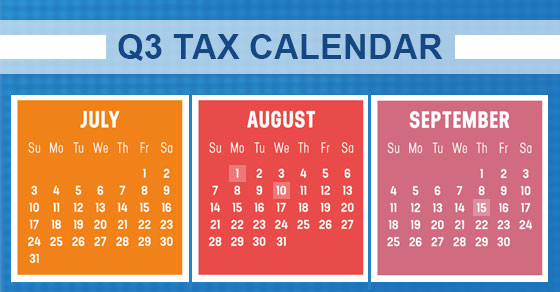

2022 Q3 tax calendar: Key deadlines for businesses and other employers

- ByPolk & Associates

- Jun, 29, 2022

- All News & Information

- Comments Off on 2022 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some key tax-related deadlines for businesses and other employers during Quarter 3 of 2022. AUG. 1: Report income tax withholding and FICA taxes for Quarter 2 of 2022 (unless eligible for Aug. 10 deadline). File a 2021 calendar-year retirement plan report or request an extension. SEPT. 15: If you operate a calendar-year partnership or S corp. that filed an extension, file a 2021 income tax return. If a calendar-year C corp., pay third installment of 2022 estimated income taxes. Contact us for more about the filing requirements and to ensure you meet all applicable deadlines.

Checking in on your accounts payable processes

- ByPolk & Associates

- Jun, 16, 2022

- All News & Information

- Comments Off on Checking in on your accounts payable processes

Managing accounts payable is a critical task for every business. However, once in place, payment processes can get taken for granted. Don’t underestimate the impact of accounts payable on your company’s financial performance. Explore the potential benefits of early payment discounts, volume discounts or other incentives. Implement policies, procedures and systems to ensure that you properly vet vendors and negotiate the best possible prices and payment terms. And of course, regularly examine whether and how to upgrade your accounts payable technology to increase efficiency, reduce costs and shorten the time it takes to process invoices. We can help you identify areas of improvement.

Your estate plan: Don’t forget about income tax planning

- ByPolk & Associates

- Jun, 16, 2022

- All News & Information

- Comments Off on Your estate plan: Don’t forget about income tax planning

The current federal estate tax exemption ($12.06 million in 2022) means that many people aren’t concerned with estate tax. But they should still plan to save income taxes. For example, be careful making lifetime transfers of appreciated assets. It’s true that the assets and future appreciation generated by them are removed from your estate. But the gift carries a potential income tax cost because the recipient receives your basis upon transfer. He or she could face capital gains tax on the future sale of the gifted property. If the appreciated property is held until death, under current law, the heir will get a “step-up” in basis that will reduce or wipe out the capital gains tax.

Is your corporation eligible for the dividends-received deduction?

- ByPolk & Associates

- Jun, 16, 2022

- All News & Information

- Comments Off on Is your corporation eligible for the dividends-received deduction?

There’s a valuable tax deduction available to a C corporation when it receives dividends. The “dividends-received deduction” reduces or eliminates an extra level of tax on dividends received. As a result, a corporation will typically be taxed at a lower rate on dividends than capital gains. Ordinarily, the deduction is 50% of the dividend, meaning only 50% of the dividend received is effectively subject to tax. For example, if a corporation receives a $1,000 dividend, it includes $1,000 in income, but after the $500 dividends-received deduction, its taxable income from the dividend is only $500. The tax break may be higher or lower, depending on the circumstances, and other rules apply.

Simple ways to make strategic planning a reality

- ByPolk & Associates

- Jun, 08, 2022

- All News & Information

- Comments Off on Simple ways to make strategic planning a reality

The term “strategic planning” is so broad. Perhaps you and your leadership team often find yourselves overwhelmed by all the directions you could go in. Here are a few simple ways to make strategic planning a reality: 1) focus on who you already know; that is, consider developing deeper relationships with customers or partnering with other businesses, 2) dig deeper into social media to highlight specific products or services, and better familiarize the buying public with your brand and culture, and 3) reevaluate your pricing strategy, delving into possibilities such as bundling or subscriptions. Contact us for help assessing the profitability impact of your strategic planning ideas.

Social Security benefits: Do you have to pay tax on them?

- ByPolk & Associates

- Jun, 08, 2022

- All News & Information

- Comments Off on Social Security benefits: Do you have to pay tax on them?

If you’ve begun receiving Social Security benefits, you may wonder: Will my benefits be taxed? It depends on your other income. If you’re taxed, up to 85% of your payments could be hit with federal income tax. If you file a joint tax return and your “provisional income,” plus half your Social Security benefits, isn’t above $32,000 ($25,000 if unmarried), none of your benefits will be taxed. If it falls above those amounts, you must report a certain percentage of your benefits as income. If you know your Social Security benefits will be taxed, you can arrange to have the tax withheld from the payments. Otherwise, you may have to make estimated tax payments. Contact us for more information.

Help when needed: Apply the research credit against payroll taxes

- ByPolk & Associates

- Jun, 08, 2022

- All News & Information

- Comments Off on Help when needed: Apply the research credit against payroll taxes

If your small business or start-up is planning to claim the research tax credit, here’s an option. Subject to limits, you can elect to apply all or some of research tax credits that you earn against payroll taxes instead of your income tax. Many new businesses, even if they have some cash flow, or even net positive cash flow and/or a book profit, pay no income taxes and won’t for some time. Thus, there’s no amount against which business credits, including the research credit, can be applied. On the other hand, a wage-paying business, even a new one, has payroll tax liabilities. The payroll tax election is an opportunity to get immediate use out of the research credits that a business earns.

Is it a good time for a Roth conversion?

- ByPolk & Associates

- Jun, 01, 2022

- All News & Information

- Comments Off on Is it a good time for a Roth conversion?

The stock market downturn has caused the value of some retirement accounts to decrease. But if you have a traditional IRA, a downturn may provide a valuable opportunity: It may allow you to convert to a Roth IRA at a lower tax cost. Roth IRA qualified withdrawals are tax free and you don’t have to begin taking RMDs after you reach age 72. But if you convert to a Roth, you’ll owe income tax on the converted amount. If your traditional IRA has lost value due to a market downturn, converting to a Roth now will minimize the tax, and you’ll avoid tax on future appreciation. Interested? Contact us to see whether a conversion is right for you.

Calculating corporate estimated tax

- ByPolk & Associates

- Jun, 01, 2022

- All News & Information

- Comments Off on Calculating corporate estimated tax

The next quarterly estimated tax payment deadline is June 15 for individuals and businesses so it’s a good time to review the rules for computing corporate federal estimated payments. You want your business to pay the minimum amount of estimated taxes without triggering the penalty for underpayment of estimated tax. The required installment of estimated tax that a corporation must pay to avoid a penalty is the lowest amount determined under each of these four methods: The current year method, the preceding year method, the annualized income method or the seasonal income method. Contact us to determine which method is best for your corporation.