Tax issues to assess when converting from a C corporation to an S corporation

- ByPolk & Associates

- Apr, 13, 2022

- All News & Information

- Comments Off on Tax issues to assess when converting from a C corporation to an S corporation

Although S corporations may provide tax advantages over C corporations, there are a number of potentially costly tax issues that you should assess before making a decision to switch. Here are 4 important issues to consider when converting from a C corp to an S corp: 1) Built-in gains tax; 2) Passive income; 3) LIFO inventories; and 4) Unused losses. There are strategies for eliminating or minimizing some of these tax problems and for avoiding unnecessary pitfalls related to them. But a lot depends upon your company’s particular circumstances. Contact us to discuss the effect of these and other potential problems, along with possible strategies for dealing with them.

Once you file your tax return, consider these 3 issues

- ByPolk & Associates

- Apr, 13, 2022

- All News & Information

- Comments Off on Once you file your tax return, consider these 3 issues

After filing a 2021 tax return, keep these three issues in mind: 1) You can check on your refund by going to irs.gov. Click on “Get Your Refund Status.” 2) Some tax records can now be thrown out. You should generally save statements, receipts, etc. for three years after filing (those related to the 2018 tax year). However, keep the actual returns indefinitely. There are exceptions to the general rule. 3) If you forgot something, you can file an amended tax return. In general, you can file Form 1040-X to claim a refund within three years after the date you filed the original return or within two years of the date you paid the tax, whichever is later. Questions? Contact us.

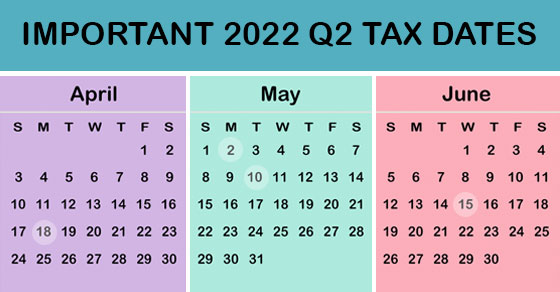

2022 Q2 tax calendar: Key deadlines for businesses and other employers

- ByPolk & Associates

- Apr, 08, 2022

- All News & Information

- Comments Off on 2022 Q2 tax calendar: Key deadlines for businesses and other employers

Here are some key tax deadlines for businesses during the second quarter of 2022. APRIL 18: If you’re a calendar-year corporation, file a 2021 income tax return (Form 1120) or file for a six-month extension (Form 7004) and pay any tax due. APRIL 18: Corporations pay the first installment of 2022 estimated income taxes. MAY 2: Employers report income tax withholding and FICA taxes for Q1 2022 (Form 941) and pay any tax due. JUNE 15: Corporations pay the second installment of 2022 estimated income taxes. Contact us to learn more about filing requirements and ensure you meet all applicable deadlines.

It’s almost that time of year again! If you’re not ready, file for an extension

- ByPolk & Associates

- Apr, 08, 2022

- All News & Information

- Comments Off on It’s almost that time of year again! If you’re not ready, file for an extension

The clock is ticking down to the April 18 tax filing deadline. Sometimes, it’s not possible to gather your tax information and file by the due date. If you need more time, you should file for an extension on Form 4868. An extension will give you until October 17 to file and allows you to avoid incurring “failure-to-file” penalties. However, it only provides extra time to file, not to pay. Whatever tax you estimate is owed must still be sent by April 18, or you’ll incur a failure-to-pay penalty and it can be steep. Contact us if you have questions about IRS penalties or about filing Form 4868.

Undertaking a pay equity audit at your business

- ByPolk & Associates

- Apr, 08, 2022

- All News & Information

- Comments Off on Undertaking a pay equity audit at your business

Providing equal compensation to employees who perform the same or similar jobs, while accounting for differences in experience and tenure, isn’t easy. That’s why every business should consider undertaking a pay equity audit. Its purpose is to: 1) uncover compensation disparities, 2) identify drivers behind them, and 3) develop ways to address pay inequity. The effort typically begins by assembling a cross section of participants from multiple departments to gather data. Next, you must determine how to group employees in substantially similar roles. Last, you need to crunch the numbers. This task could involve complex statistical analyses for larger companies. Contact us for help.

Fully deduct business meals this year

- ByPolk & Associates

- Apr, 08, 2022

- All News & Information

- Comments Off on Fully deduct business meals this year

The federal government is helping to pick up the tab for certain business meals. Under one of the COVID-19 relief laws, the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by restaurants in 2022 (and 2021). So, you can take a customer out for a business meal or order take-out for your team and write off the entire cost — including the tip, sales tax and any delivery charges. In the event that food and beverages are provided during an entertainment activity, the food and beverages must be purchased separately from the entertainment. Alternatively, the cost can be stated separately from the cost of the entertainment on one or more bills.

Selling mutual fund shares: What are the tax implications?

- ByPolk & Associates

- Apr, 08, 2022

- All News & Information

- Comments Off on Selling mutual fund shares: What are the tax implications?

For tax purposes, the rules involved in selling mutual fund shares can be complex. If you sell appreciated fund shares that you’ve owned for more than one year, the profit will be a long-term capital gain. The top federal income tax rate will be 20% and you may also owe the 3.8% net investment income tax. One challenge is that certain mutual fund transactions are treated as sales even though they might not seem like it. For example, many funds provide check-writing privileges. Each time you write a check on your fund account, you’re selling shares. Another problem may arise in determining your basis for shares sold. We can explain in greater detail how the rules apply in your situation.

AI for small to midsize businesses isn’t going away

- ByPolk & Associates

- Apr, 08, 2022

- All News & Information

- Comments Off on AI for small to midsize businesses isn’t going away

Artificial intelligence (AI) has risen to great prominence in certain industries. But it hasn’t reached every small to midsize business yet. This will likely change as the technology becomes less expensive and more widely available. AI generally refers to using computers to perform complex tasks typically thought to require human intelligence, such as image perception, voice recognition and problem-solving. Just a few ways that AI could help your company include: 1) expediting the hiring process by soliciting and screening candidates, 2) more efficiently and effectively communicating with customers and prospects, and 3) strengthening your cybersecurity systems. Contact us for more info.

Taking the opposite approach: Ways your business can accelerate taxable income and defer deductions

- ByPolk & Associates

- Mar, 24, 2022

- All News & Information

- Comments Off on Taking the opposite approach: Ways your business can accelerate taxable income and defer deductions

Businesses typically want to delay taxable income into future years and accelerate deductions into the current year. But sometimes they want to do the opposite. One reason might be tax law changes that raise tax rates. Another reason may be because you expect your pass-through entity to pay taxes at higher rates in the future. There are ways to accelerate income into the current year and delay deductions into later years. For example, sell appreciated assets that have capital gains in this year, rather than waiting until a future year. Or depreciate assets over a number of years rather than claiming big first-year Section 179 deductions or bonus depreciation deductions. Contact us for help.

ERISA and EAPs: What’s the deal?

- ByPolk & Associates

- Mar, 24, 2022

- All News & Information

- Comments Off on ERISA and EAPs: What’s the deal?

Many businesses are trying to help workers cope with challenges such as substance dependence, financial and legal woes, and mental health. Among the options considered is an employee assistance program (EAP). A common question is: Are these programs subject to ERISA? Generally, an arrangement is an ERISA welfare benefit plan if it’s a plan, fund or program established or maintained to provide ERISA-listed benefits, which include medical services. So, generally, an EAP providing mental health counseling (including help with substance abuse) will probably be subject to ERISA. You’ll need to also assess potential compliance issues under the ACA and HIPAA. Contact us for more info.